what percentage of taxes are taken out of paycheck in nc

Check out Sovereign Kava for a truly must-do Asheville experience OPEN DAILY 8285058118 268 Biltmore Ave Asheville NC WWWASHEVILLEKAVACOM 28 MAY 11-17 2022. And our state typically has a 40 reduction requirement in order to be eligible.

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

My experience is that when filing you can opt to have taxes taken out like you would your normal paycheck.

. Child Tax Credit The 2021 Child Tax Credit is up to 3600 for each qualifying child. The same goes for a housing allowance paid to ministers that own or rent their homes. Yes the cap in NC is 350 before taxes though you may be right that this may change for COVID-specific claims.

North Carolina taxpayers may qualify for a tax deduction for the contributions to the 529 plan. Residents state taxes on your earnings. Your earnings grow tax-free.

Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit through April 15 2025 by filing a federal tax returneven if they dont normally file. There are NO federal taxes or for NC. You can select from a variety of investment options that cover a range of strategies from conservative to aggressive.

The eligible housing allowance amount is exempt from federal income taxes but not from self-employment taxes Social Security and medicare unless a minister has filed a Form 4361 and been approved to opt out of social security. Lines of credit interest rates on short term loans when one of Wal Marts paycheck to paycheck customers overdrafts their bank account for a couple of dollars and has to pay an NSF Fee ranging. So sorry you have to take this step.

How The Tax Burden Has Changed Since 1960

2022 Federal Payroll Tax Rates Abacus Payroll

1 200 After Tax Us Breakdown June 2022 Incomeaftertax Com

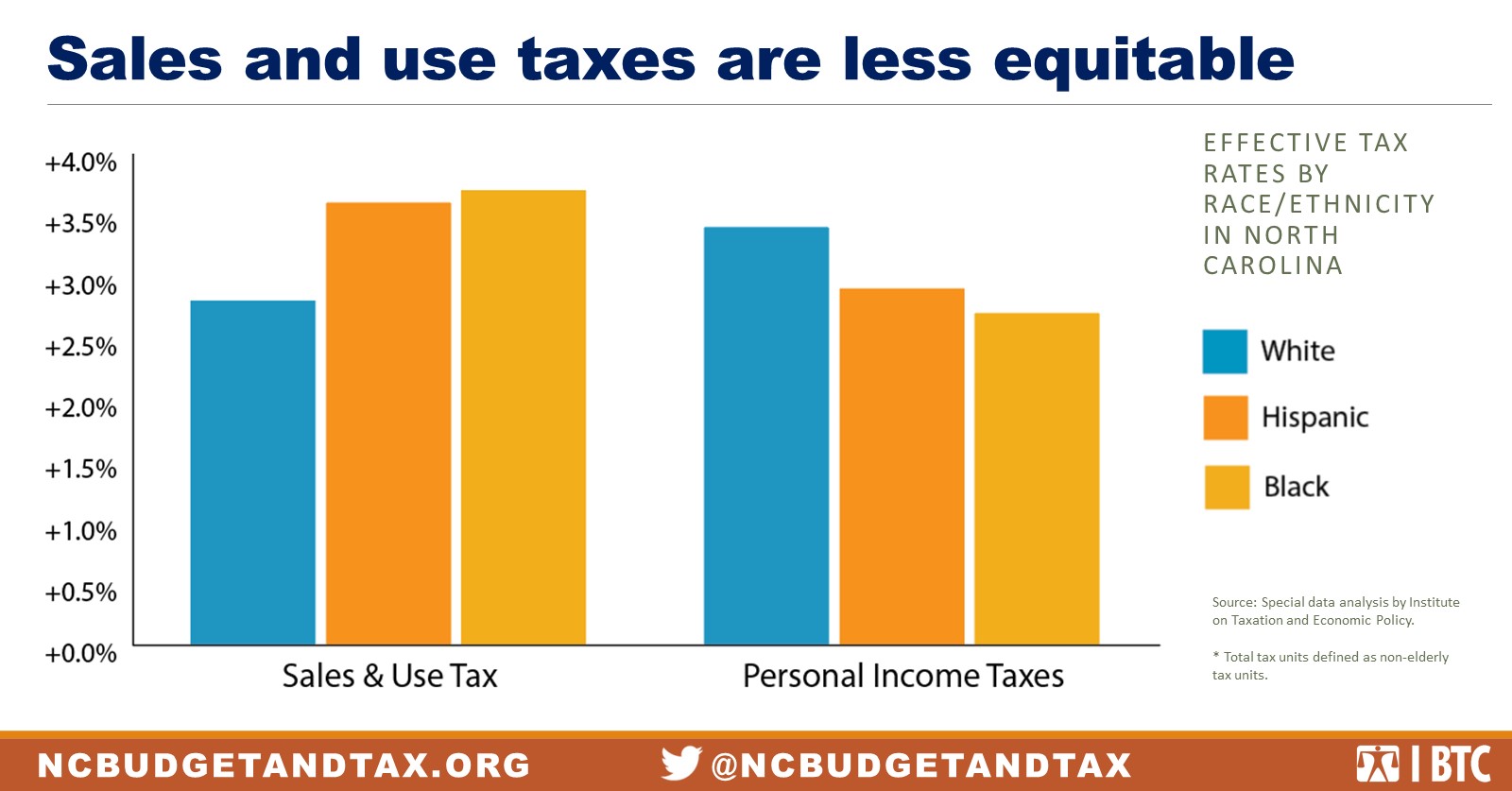

State Tax Policy Is Not Race Neutral North Carolina Justice Center

Taxes On Vacation Payout Tax Rates How To Calculate More

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Is Local Income Tax Types States With Local Income Tax More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina Paycheck Calculator Smartasset

2022 Federal State Payroll Tax Rates For Employers

Understanding Payroll Taxes And Who Pays Them Smartasset

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)